The Bitcoin halving stands as one of the most significant cyclical events in cryptocurrency economics. As Bitcoin moves toward its next halving, a pressing question rises to the surface: What happens when miners find it hard to stay profitable? The answer may exist in a practical solution called merge mining. Elastos is positioned as the perfect companion for miners looking to keep and even improve their earnings.

Recent data points to a troubling trend for Bitcoin miners. Profitability metrics have plummeted to historic lows, putting pressure on mining operations worldwide. With hashrate continuing to climb despite diminishing returns, many miners find themselves caught in a bind: shut down operations and waste their investment in equipment, or continue mining at a loss in hopes that Bitcoin’s price will eventually compensate for halvings. This dilemma grows more acute with each halving cycle, and the industry desperately needs a sustainable path forward.

The Historical Impact of Bitcoin Halvings on Miner Profitability

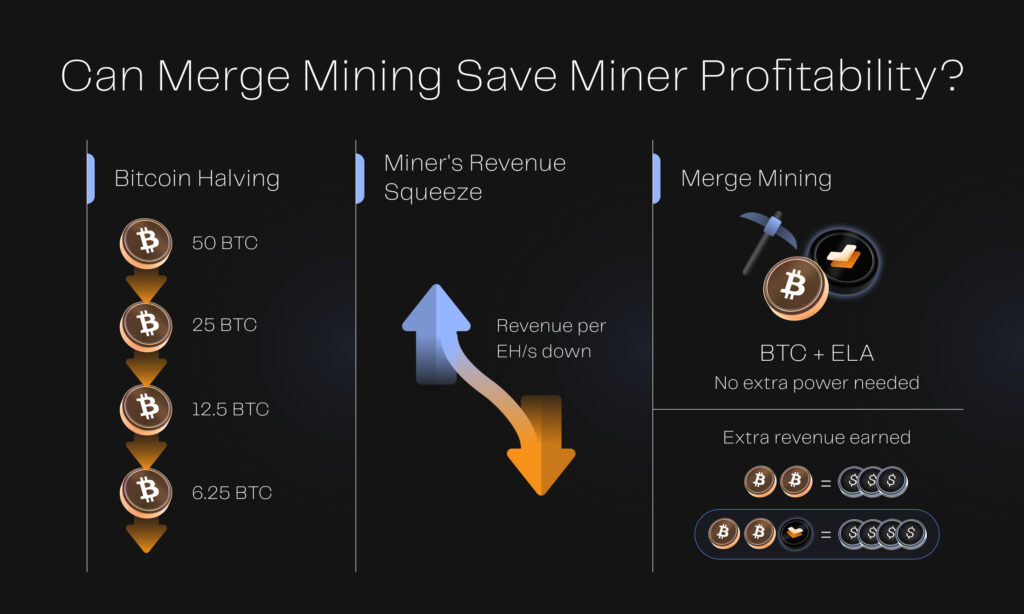

Bitcoin’s monetary policy hardcodes a deflationary schedule into its protocol. Every four years, the reward miners receive for solving blocks gets slashed in half. It started from the original 50 BTC per block in 2009 to just 6.25 BTC today. The next halving will further reduce this to a mere 3.125 BTC per block.

After each previous halving, Bitcoin’s price eventually rose enough to offset the reduced block rewards. The 2012 halving saw Bitcoin climb from $12 to over $650. Following the 2016 event, prices eventually reached nearly $20,000. The 2020 halving preceded Bitcoin’s climb from $8,500 to $69,000. These price increases kept mining profitable despite the reward cuts.

However, these price gains mask a troubling reality for miners. While Bitcoin’s value has increased, the economics of mining have steadily deteriorated. Three powerful forces work against miner profitability regardless of Bitcoin’s price: exploding network hashrate, rising electricity costs worldwide, and the growing sophistication of mining equipment requiring larger capital investments.

The result? Even as Bitcoin’s dollar value climbed, the average miner’s share of the network and their profit margins have shrunk dramatically. A small mining operation that could turn a healthy profit in 2016 would need to multiply its investment tenfold just to stay competitive today. Each halving exponentially worsens this equation. When the next halving cuts rewards by another 50%, many miners will face a brutal choice: find additional revenue streams or shut down permanently.

Bitcoin Mining Profitability Crisis Deepens in 2024

A JPMorgan report in 2024 paints an ominous picture of the current state of Bitcoin mining. In August 2024, miner profitability hit an all-time low of just $43,600 per exahash per second (EH/s) in daily block reward revenue. This marks a dramatic fall from the peak of $342,000 in November 2021.

This profitability crisis has already taken its toll on the industry, with the market cap of U.S.-listed Bitcoin miners falling 15% in August 2024 alone, now totaling $20 billion. Major mining companies like CleanSpark, Marathon Digital, and Riot Platforms have seen their stock prices tumble over the last handful of years.

The troubling reality is that this downward trend in profitability might continue with future halvings. Each halving event places more pressure on miners as their block rewards shrink while operational costs remain steady or increase. Without new revenue streams, many mining operations may become unsustainable.

Merge Mining: The Overlooked Solution for Mining Economics

Merge mining offers a way out of this bind. This technique lets miners work on multiple blockchains at once using the same equipment and energy. The key point is that miners can earn extra tokens without spending more on power or hardware.

Among merge mining options, Elastos stands out. As explained in the Top 5 Merge Mined Coins article, “Elastos transforms Bitcoin from digital gold into the backbone of a decentralized financial system… The network secures more than half of Bitcoin’s total hashpower with 481 EH/s, worth billions yearly!”

This means Bitcoin miners can earn ELA tokens on top of their BTC rewards without any extra costs. For miners worried about post-halving profits, this added income stream could mean the difference between staying in business or shutting down operations.

BeL2: Elastos Already Putting Bitcoin to Work

Elastos has already built tools that make Bitcoin more useful. BeL2, Elastos’ Bitcoin Layer 2 solution, opens up Bitcoin’s $2 trillion+ market cap for DeFi without middlemen or wrapped tokens.

Using Zero-Knowledge Proofs, BeL2 creates native Bitcoin finance where users can earn yield in Bitcoin and Elastos. The recent $20M backing from Rollman Capital shows serious belief in this system.

Most exciting for miners is BeL2’s stablecoin project. The Harvard alumni-backed “New Bretton Woods Labs” project aims to create a Bitcoin-based economy that fixes the problems of today’s money. Their Native Bitcoin Stablecoin, pegged 1:1 to USD, lets Bitcoin holders create stablecoins or borrow money without selling their Bitcoin.

This system creates more ways to use Bitcoin, which adds value to the Bitcoin miners help secure. More uses mean more demand, which helps keep prices up even when supply growth slows after halvings.

Why This Matters for Miners Now

With Bitcoin mining profitability hitting record lows in 2024, the situation looks dire. JPMorgan’s estimate of $43,600 per EH/s is down dramatically from $342,000 in 2021. This fact signals a dangerous trend that will only worsen with future halvings.

The expected reduction to 3.125 BTC per block in the next halving will put unprecedented pressure on miners already struggling with thin margins. If August 2024’s all-time low profitability comes during a time with 6.25 BTC rewards, the mining economics after another 50% cut could prove fatal for many operations.

Smart miners are already looking at merge mining Elastos as their safety net. By earning ELA alongside BTC, they create a buffer against the halving’s effects. Plus, projects like BeL2 make the broader Bitcoin system more useful and valuable.

For miners worried about survival in an era of record-low profitability, the message is clear: look beyond just Bitcoin. The solution exists today in merge mining, and Elastos offers the most fully-formed option with real-world uses already running.

Miners who adapt now won’t just survive the next halving. They’ll come out stronger on the other side. Ready to merge-mine ELA? Learn how to do.